Are you looking for an essay on the ‘Banks of India’? Find paragraphs, long and short essays on the ‘Banks of India’ especially written for college and banking students.

Essay on the Banks of India

Essay Contents:

- Essay on the Reserve Bank of India

- Essay on the State Bank of India

- Essay on Commercial Banks

- Essay on Regional Rural Banks

- Essay on Industrial Development Banks

- Essay on NABARD

- Essay on Land Development Bank

- Essay on Co-Operative Bank

- Essay on National Housing Bank

- Essay on Saving Bank

Essay on Bank # 1. Reserve Bank of India:

Reserve Bank of India is the Central Bank of India. It is also called the bank of banks. It was established on 1 April, 1935 under the Reserve Bank of India Act, 1934. Its authorised capital at the time of foundation was five crore rupees, which was divided into 5 lakhs shares of rupees hundred each.

Reserve Bank of India was nationalised on 1 January, 1949. Reserve Bank reserves the right of issuing paper notes. Besides, it also performs the task of credit control and controlling and regulating the commercial banks of India. Its role as the banker of the government is important. Mr. Urjit Patel is the 24th Governor of Reserve Bank of India.

Essay on Bank # 2. State Bank of India:

The State Bank of India wag established on 1st July, 1955 after the nationalisation of Imperial Bank of India. Its Authorised Capital at the time of establishment was twenty crore rupees. It was divided into 20 lakhs shares of rupees hundred each. Later on its Authorised Capital was increased to 200 crore rupees.

Presently the authorised capital of SBI is Rs. 5,000 crores divided into five thousand crores equity share of Rs. 1. State Bank of India is not the Central Bank of the country, but it acts as the representative of Reserve Bank of India in places which don’t have branches of RBI. This way State Bank of India performs as the agent of RBI besides undertaking common banking function.

There are five associate banks of SBI:

These are:

(i) State Bank of Bikaner and Jaipur,

(ii) State Bank of Hyderabad,

(iii) State Bank of Mysore,

(iv) State Bank of Patiala, and

(v) State Bank of Travancore.

The Authorised Capital of these associate banks is in the ownership of the Capital of State Bank of India. As regards the capital of State Bank of India, its bigger portion is within Reserve Bank of India.

Essay on Bank # 3. Commercial Banks:

Commercial banks are the most popular banks of the country. The prime functions of commercial banks include accepting deposits from people and advancing loans to traders and common people. These banks perform with the objective of earning profit. Besides primary functions, these banks also perform general utility functions and agency functions.

Commercial banks can be classified into following two categories:

(A) Scheduled Bank:

A bank enlisted in the second schedule of the Reserve Bank Act, 1934 is called a Scheduled Bank.

According to the Section 42 (6) Reserve Bank includes only those banks in this list which fulfill following conditions:

(i) The bank has at least five lakhs rupees as Paid-up Capital.

(ii) Reserve Bank must be assured that any activity of the bank would not be harmful for the depositors.

Scheduled Banks in India are those banks which have been included in the Second Schedule of Reserve Bank of India (RBI) Act, 1934. RBI in turn includes only those banks in this schedule which satisfy the criteria laid down vide section 42 (6) (a) of the Act. Reserve Banks provides certain facilities to these banks.

Some of the important facilities provided are as follows:

(a) Every Scheduled bank automatically gets the membership of clearing house.

(b) It can get loan from RBI at bank rate.

(c) Reserve bank grants such a bank the facility of re-discounting of bills of exchange.

(B) Non-Scheduled Bank:

Those banks which are not included in the category of Scheduled banks are called non-scheduled banks. Reserve Bank doesn’t give these banks facilities similar to scheduled banks. But according to current regulations even non-scheduled banks have come under the control of RBI.

However the number of non-scheduled banks is continuously decreasing. These banks don’t have the right of having advances from RBI, but in unfavourable circumstances they can establish relationship with RBI and can get advances. It is mandatory for such banks also to maintain a cash reserve according to Banking Regulation Act, 1949.

According to another classification of commercial banks, following are their categories:

(i) Public Sector Banks:

Public Sector Banks are those banks which have their ownership, management and regulation with the government of India. 14 banks were nationalised in India in 1969. Again 6 more banks were nationalised in 1980. But, New Bank of India was merged with Punjab National Bank in 1993. This way the number of nationalised banks became 19 excluding State Bank of India and its associates. Later I.D.B.I. Bank was also included among Public Sector Banks.

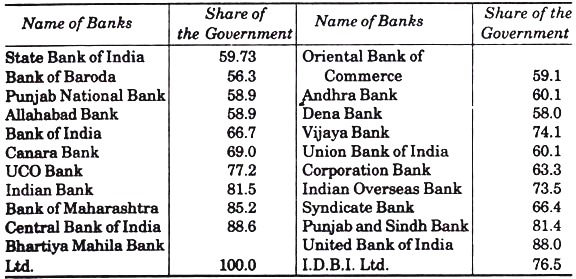

Government’s Shareholding in Public Sector Banks: [In Percent by March 2014]:

Now, the government of India has shareholding in 21 banks of the public sector. These include State Bank of India, 19 Nationalised banks and one Public Sector Bank-I.D.B.I. Limited. The government will not have less than 55 percent of equity capital of State Bank of India and 51 percent of that of Nationalised Banks and Public Sector Banks.

(ii) Private Sector Banks:

Those banks which have ownership and management in the hands private individuals fall in this category. Private Sector Banks have got much liberty in their functioning considering the entry of foreign banks in India and their easy functioning. The dissatisfaction among people regarding the activities of public sector banks is also a factor behind emergence of these banks. The Reserve Bank of India issued certain guidelines on 28th February, 2005 regarding the foundation of new banks in the private sector.

Some of these are as follows:

(a) The initial paid-up capital of private banks would be 200 crore rupees and it will have to be raised to 300 crore rupees with in a period of three years.

(b) The promoters must have at least 40 percent of the paid-up capital at any particular time.

(c) The remaining part of the initial capital excluding the share of promoters can be raised through public issues or private placements.

(d) None of the shareholders can have more than 10 percent of the total voting value in private sector banks. It is worth mentioning here that this limit is 1 percent for all public sector banks, excluding State Bank of India. In state Bank of India, the shareholders excluding RBI can have as much as 10 percent voting value.

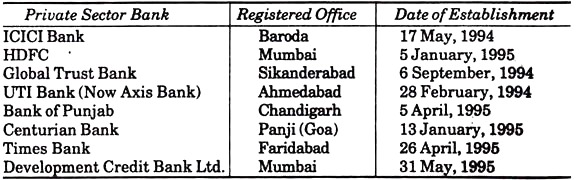

The details of the main private sector banks will be classified with the help of the following table:

(iii) Foreign Commercial Banks:

Foreign Banks get entry into India according to the policy of liberalisation adopted by the government of India. The foreigners have ownership and control over the management of these banks operating in India.

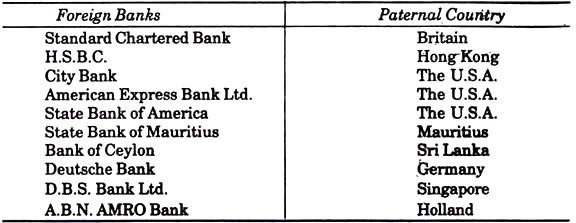

Following table will clarify the details of the main foreign banks functioning in India:

Essay on Bank # 4. Regional Rural Banks:

First Regional Rural bank was established on 2nd October, 1975 with an objective of providing the banking facilities to the rural population of India. An ordinance was issued on 26th September, 1975 to facilitate the foundation of this bank. It later transformed into Regional Rural Bank Act, 1976.

Five Regional Rural Banks were established in Moradabad and Gorakhpur in U.P., Bhivani in Haryana, Jaipur in Rajasthan, Malda in West Bangal on the day of establishment. The ownership of regional rural banks stays with the government of India, concerned State government(s) and its sponsored banks. Their issued capital is distributed among these three in the ratio 50: 15: 35.

There are nine managers in the management committee of regional rural banks. Out of these 6 are appointed by the Central government 1 by the State government and 2 by the sponsored banks.

The government started the process of merging step by step since September 2005 to strengthen these banks. 57 banks had been formed by merging 171 RRBs by March, 2012. The process of merging is still being continued. The maximum functions of these banks are for development of rural areas. Accepting deposits and advancing loans are also their main functions.

Essay on Bank # 5. Industrial Development Banks:

Industrial Development Banks grant loans to new and old industrialists for manufacturing work, purchasing machines and equipments, renewal of machineries etc. to promote industries in the country. In other words, in helping industrial establishments these banks are ahead of even commercial banks. Many industrial development banks have been set up in India.

Some of these are:

(i) IFCI (Industrial Finance Corporation of India Ltd.):

Indian Industrial Finance Limited was founded on 1 July, 1984 by a special ordinance according the suggestions of the Central Banking Inspection Committee. The objective of founding this is limited to provide medium and long-term loans to Limited Companies and Cooperative committees set up in India.

The initial Authorised Capital of the IFCI was 10 crore rupees, which was later raised to 20 crore rupees. This corporation was converted into a Limited company on 1 July, 1993. Since then its name has become Indian Industrial Finance Corporation Limited. It has also been registered under the Indian Company Act, 1956.

(ii) IDBI (Industrial Development Bank of India):

Industrial Development Bank of India was founded on 1 July, 1964. It was a subsidiary bank of RBI upto 16 February, 1976. After that it was separated from the RBI and given the status of an autonomous corporation.

The main objective of establishing this bank is providing financial assistance to industrial enterprises. It gives direct loans to big and medium industrial enterprises. But after the foundation of Small Industries Development Bank of India [SIDBI] in 1990, the responsibility of granting loans to small scale industries was taken from IDBI and given to SIDBI.

The government of India turned IDBI into a corporation and converted it into a commercial banking company to bring improvement in its working and expanding its functions. Again an ordinance was issued by RBI on 11 October, 2004 and IDBI was declared a Scheduled Bank according to Reserve Bank of India Act, 1934. The government shareholding is 52.71 percent in this bank.

(iii) ICICI (Industrial Credit and Investment Corporation of India):

ICICI was established in January, 1955. It was registered as a limited company under the Indian Company Act. Initially Ownership of its capital was with companies, institutions and private individuals. But at present its maximum share capital is with banks, LIC, General Insurance Corporation and other PSUs.

The prime objectives of the establishment of this corporation are—rapid establishment of private sector industries, granting medium and long term loans for their development and renewal and purchasing their shares. Besides these, it also has the function of underwriting of shares and debentures. But, ICICI was merged with ICICI Bank Ltd. on 30th March, 2002. After this merger ICICI Bank has emerged as the second largest commercial bank after State Bank of India. ICICI Bank has opened its branch at Colombo on 12 January, 2006.

(iv) SFC (State Finance Corporation):

The Government of India passed State Finance Corporation Act in 1951 with an objective of giving the State government the right of founding separate finance corporation for them. However in Tamil Nadu, Tamil Nadu Industries Investment Corporation had been established in 1949 under the Indian Company Act well before the foundation of this corporation. At present there are 18 State Finance Corporations, out of which 17 are formed under the State Finance Corporation Act, 1951. The remaining one has been formed under Tamil Nadu Industrial Investment Corporation.

The Central Government has amended the State Finance Corporation Act, 1951 to terminate the facility of guarantee on dividend on shares of these Corporations. State Finance Corporation (Amendment) Act, 2000 has the provision that the corporation should pay dividend only according to their own profits. It is worth mentioning here that before this amendment the shareholders of these corporations had a guarantee of 7.5 percent dividend.

According to the amendment the state government, SIDBI and other institutions controlled by state together can’t have less than 51 percent of the total capital of these corporations as their shares. In other words, the private individuals can’t have more than 49 percent of shares in these.

(v) SIDBI (Small Industries Development Bank of India):

SIDBI was established as an associate bank of Industrial Development Bank of India (IDBI) in April, 1990. Its head office is in Lucknow. It is a financial institution setup with the objective of establishing small scale industries through financial nourishment and development work. Its paid-up capital was Rs. 450 crores on 31 March, 1991. At present, its total equity capital is with IDBI.

(vi) State Industrial Development Corporation:

State Industrial Development Corporations have been set up in many states for the industrial development in states. In most of states these corporation have been set up under Indian Company Act. At present, there are 26 State Industrial Development Corporations. The objective of these corporations is to assist in development and proliferation of its industries in states.

(vii) EXIM Bank (Export-Import Bank of India):

Export-Import Bank of India was founded on 1st January, 1982. The prime objective of this bank is to provide financial assistance to exporter and importers. Its authorised capital was Rs. 500 crores in the beginning, which was raised to Rs. 1,000 crores in 1998.

Essay on Bank # 6. NABARD (National Bank for Agriculture and Rural Development):

NABARD was set up on 12 July, 1982. This Bank was established as an apex institution for agricultural and rural development. To achieve this prime objective NABARD provides refinance facilities to State Land Development Bank, State Cooperative Banks, Scheduled Commercial Banks, Regional Rural Banks etc. these institutions provide loan to promote production activities in rural areas. So long as the issue of fulfillment of loan related needs of NABARD is concerned, it gets money from the government of India, the World Bank and other agencies.

Besides these, it also raises funds by issuing bonds and shares guaranteed by government of India.

The paid-up capital of NABARD at the time of setting up was Rs. 100 crores, in which the government of India and RBI had equal shares. It was raised to 1000 crores in 1996-97, in which the government of India had a share of Rs. 200 crores and the RBI held Rs. 800 crores. The share capital of NABARD was supposed to be Rs. 2000 crores by 1999 in the budget of 1996-97. It was to be increased by Rs. 500 crores per year.

In 1996-97 its share capital was raised from Rs. 500 crores to Rs. 1000 crores. In this Rs. 500 crores, the RBI contributed Rs. 100 crores and the government of India Rs. 400 crores. With this gradual increase, the capital of NABARD reached to the level of Rs. 5000 crores in March, 2012.

Essay on Bank # 7. Land Development Bank:

This bank has been established to meet the long and medium term financial needs of farmers. Its former name is Land Mortgage Bank. Land Development Bank keeps the immovable assets as mortgage and grants loans up to 50 percent of their face value.

These banks generally give loan to purchase land, repay off old loans, purchase farm equipments etc. This bank gives loan for a period of 5 to 20 years. The main sources of the capital of Land Development Bank are share capitals, reserve fund, deposits, debentures and loans.

Land Development Bank had started as Land Mortgage Bank in Chennai. This state had set up Central Land Mortgage Bank in 1929 by joining the primary banks of the state. After this, it was set up in many states.

Essay on Bank # 8. Co-Operative Bank:

Co-operative Bank was first set up in Germany around the end of the 19th century. It was set up in India in 1904 after its popularity in Italy, England, Ireland, Denmark etc. The main objective of the co-operative bank is to provide short-term financial aids to farmers and labourers. There are Rural Cooperative Credit Committees for rural areas. It can be founded by a minimum of 10 persons coming together.

According to the definition for a Co-operative Bank as stated in Banking Regulation Act, effective on 1st March, 1996, “A co-operative bank means a Central Co-operative bank, a state Co-operative bank or a primary co-operative bank.” In this context, a central co-operative bank means the main co-operative bank of a district.

Similarly, a state co-operative committee is main co-operative committee of that state. It has the task pi; providing loans to all other co-operative committee of the states. So long as a primary co-operative bank is concerned, it means such a co-operative committee which provides short term loans to its members from the rural areas. Co-operative banks are not very popular in India.

Essay on Bank # 9. National Housing Bank:

National Housing Bank was set up in July, 1988. It was set up with the objective of meeting the housing related financial needs in the country. It was set up as assisting institution of RBI.

National Housing Bank launched ‘Housing Loan Account’ Scheme on 1st July, 1989. Commercial banks serve as a medium for the successful implementation of this scheme. Under this scheme, a person willing to get loan for the construction of house, gets an account opened with a commercial bank and deposits a fixed sum per month for a period of 5 years. After five years he/she gets a certain amount as a loan for the construction of house, besides getting back his/her own deposited sum.

Essay on Bank # 10. Saving Bank:

Saving bank means a bank that accepts small savings of people with low income as deposits to encourage capital formation. Such banks give interest on deposits. In India, the post-office savings banks perform this task.

There are many attractive schemes with the post-office savings banks, for example—Savings Accounts, Recurring Deposits Accounts, National Saving Certificate, National Saving Scheme, Public Provident Fund etc. the post office also accepts deposits from people through authorized agents.