Are you looking for an essay on the ‘Credit Control Policy by the Reserve Bank of India’? Find paragraphs, long and short essays on the ‘Credit Control Policy by the Reserve Bank of India’ especially written for school and banking students.

Essay on the Reserve Bank of India

For the economic development of any developing country, there is the need of economic prosperity, social justice and price stability. In India, the central bank operates its monetary policy through credit control policy. That is why the credit control policy is also called the monetary policy. As the central bank of India, the RBI performs the important task of credit control.

In recent years, the RBI has adopted such policies of credit control which can provide economic assistance of agriculture, trade, industries and the people of the weaker section of society. At the same time, it has also the task of observing the credit is used for the work only for which it has been provided.

Essay # 1. Objectives of Credit Control:

The main objectives of credit control by the RBI are as follow:

(1) Price Stability:

Price stability is an important objective of credit control. For it, the inflation rate has to be maintained by 6 per cent.

(2) Reduction in Interest Rate:

There is an increase in investment by reducing the interest rate. Thus, reducing the rate of interest is an objective of credit control.

(3) Reducing Deficit:

By credit control the fiscal deficit of the government reduces.

(4) Economic Growth:

Economic growth is obtained by speeding up the activation of various government projects.

(5) Social Justice:

An attempt establishing social justice is made by bringing uniformity in the distribution of income and wealth by credit control.

Essay # 2. Methods of Credit Control:

The RBI performs the task of credit control generally by following two methods:

(A) Quantitative or General Credit Control

(B) Selective or Qualitative Credit Control.

(A) Quantitative or General Credit Control:

Under it, the Reserve Bank of India controls the credit through following instruments:

(1) Bank Rate:

Bank Rate is the most important monetary measures of credit control. Bank Rate is the rate at which the RBI gives loans to the commercial banks and does the discounting of trade bills. When there is an expansion of the amount of credit in the market, the RBI increases the Bank Rate.

As a result, the rate of interest rises in the market. The trading class starts repaying their loans and at the same time, there is also a decline in the rate of taking loans. On the contrary, when the RBI observes that the amount of credit in the market has reduced, it lowers the Bank Rate. Consequently, the commercial banks also start giving credit on less interest rate. This increases the flow of credit.

Bank rate has been changed many times for the credit control. The Bank rate was 4 per cent in 1862 which was raised to 4.5 per cent in 1963 and 5 per cent in 1964. Again in 1965, it became 6 per cent and it was raised to 7 per cent in 1973.

After this, there were many increases in it. It became 9 per cent in 1974,10 per cent in 1981, and 11 per cent on 4th July, 1991. After a short period only, it was raised to be 12 per cent on 1st October, 1991. Again, there was a great reduction in this also. It was lowered up to 6 per cent in April, 2003. At present also, it is 7 per cent only.

(2) Open Market Operations:

Open Market Operations refer to the selling and purchasing of the government securities, first class bills and promissory notes by the RBI. The RBI sells and purchases the securities in the open market for regulating the amount of credit. According to the section 17 of the Reserve Bank of India Act, 1934, the RBI retains the right of selling, purchasing and rediscounting of such trading bills and promissory note which have to be paid in India within 90 days.

The RBI can get the agricultural bills for the period of 15 months re-discounted or even sell and purchase these. The open market operations were very limited till the World Weir II, but after it, these activities were adopted on large scale for regulating the amount of credit by purchase of securities are done in the open market by RBI as per needs.

(3) Variable Cash-Reserve Ratio:

According to the section 42 (1) of the Reserve Bank of India Act, 1934 every commercial bank has to keep a definite per cent of their deposit with RBI. It is called Cash Reserve Ratio (CRR). Initially it was fixed at 5 per cent of demand deposit and 2 per cent of fixed deposit.

After the two amendments in 1962, the RBI got the freedom of adopting a flexible approach. At the same time, in place of having two separate CRRs for two different deposits, it got the right of considering a common rate. In this amendment, the RBI got the right to determine the CRR between 3 and 15 per cent.

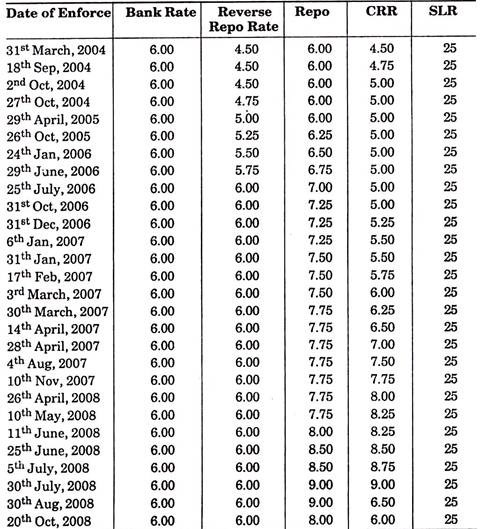

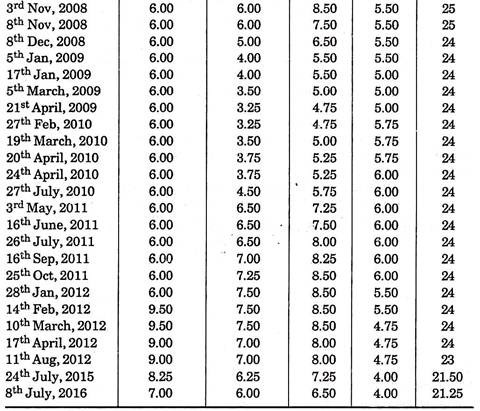

The RBI used this right many times. In June 1973 the CRR was raised from 3 per cent to 5 per cent and in September 1973 it was determined at 7 per cent. Again it was fixed at 8.5 per cent in August 1983, 10 per cent in October 1987 and at its maximum 15 per cent in April, 1991. For many reasons, there were several reductions in it in 1997, but there remained a lack in stability. CRR was fixed at 4.5 per cent on 31st March, 2004 which was again raised up to 4.75 per cent on 18th September, 2004.

Again, on 2nd October, 2004, it was fixed at 5 per cent which remained stable for a long time. It was 5.25 per cent on 23rd December, 2006. After this, also it fluctuated frequently. On the rate declared on 21st April, 2009, it was 5 per cent. Similarly on 13th February, 2010 it was fixed 5.50 per cent, 27th February, 2010, 5.75 per cent and on 8th July, 2016, 4 per cent. The RBI controls the liquidity of commercial banks through CRR.

(4) Statutory Liquidity Ratio—(SLR):

According to the section 24 of the Banking Companies Act 1949, it was made essential for the scheduled Bank that they should keep at least 20 per cent of their wealth as cash, gold or government securities as a form of liquid money.

Again, it was raised from time to time to rise up to 25 per cent and 38.5 per cent in 1991. But after the recommendations at the Narsimham Committee in 1991, SLR was reduced in many steps and stabilised at 25 per cent. But on 8th November, 2008, it was reduced by 1 per cent and fixed at 24 percent. At present SLR is 21 per cent.

(5) Direct Action:

According to the Banking Companies Act, 1949, the RBI retains the authority of direct action. According to it, the RBI can ban any particular type of transactions by banks and do any special observation at any time. After the observation, it can give suggestion or order in any particular issue. The RBI has taken the help of direct action from time to time.

(6) Moral Suasion:

The RBI also takes the help of Moral Suasion for credit control. According to it, the RBI persuades the commercial banks to follow the policies declared by it.

The Table Representing the Fluctuations in the Main Policy Rates and Expected Reserve Funds

(B) Selective or Qualitative Credit Control:

The selective or Qualitative Credit Control refers to that technique of RBI under which it orders to provide credit to member countries for the fulfillment of certain objectives. This system of credit control was established by RBI in May 1956. The price rise can be controlled using this method.

The RBI gives instructions to banks from time to time for making the selective or qualitative credit control more effective. If it considers it essential, it can give supplementary orders besides the general orders. According to this method of credit control, the RBI determines the maximum limit of credit in certain sectors. Any bank cannot grant loan beyond this limit without the permission of the RBI.

The RBI has marked some commodities for checking the price rise, black marketing and speculation. At present, the list of selected goods include food grains, oil seeds, sugar, jaggery, khandsari, vegetable oil, cotton and cotton clothes. It is a clear instruction from the RBI to other banks that they should provide credit to the producers and traders of these commodities according to the instructions of the RBI only.

Essay # 3. Evaluation of Credit Control Policy of the Reserve Bank:

The RBI has adopted many measures for the credit control. Now, there is a question regarding the success of these measures in the direction of credit control.

In this direction, it can be said that the RBI has been successful in providing sufficient credit facilities for agriculture, trade, industries, export etc. to strengthen the economy.

But there was a challenge of maintaining stability with development. It could not be successful in it. It considers the government policy responsible for it. The RBI could not control the inflation rate also; however the reason for it was started to be the lack of co-ordination between the monetary policy and fiscal policy. What so ever be the reason, the critics hold that the RBI has been unsuccessful in credit control.

Following are the reasons of the failure of the credit control policies of the RBI as per the views of the critics:

(1) No Control on Non-Banking Institutions:

A major portion of the country’s banking system is controlled by non-banking institutions. The native bankers have much contribution in the trade and industries of the country. But despite this, the RBI has no control over these institutions. Due to it, the RBI has not got much success in its credit control policy.

(2) Lack of Co-Ordination between Monetary and Fiscal Policy:

The monetary policy is operated by the RBI, while the fiscal policy is operated by the government. There is a lack of co-ordination between these two policies. The government has monetarised the budget deficit. This weakens the monetary policy.

(3) Lack of Organised Bill Market:

There is a lack of organised bill market in India even today. As a result, the discounting of bills has remained ineffective. It is also the main cause of the unpopularity of the bank rate.

(4) Excess Cash Reserve with Banks:

The scheduled banks of the country have so much deposit with them that even after maintaining CRR determined by the RBI, they have sufficient cash with them. With the help of it, they keep on forming up credit in their own ways.

(5) Lack of Elasticity in Economy:

The credit control has a direct and clear relationship with economy, but there is a lack of elasticity in the Indian economy. If there is a change in the bank rate, its direct impact should be on the prices of commodities, wages, interest rates etc. but in practical it is not so.

(6) Lack of Organised Money Market:

There is a lack of organised money market in India. The bank rate issued by the RBI and the interest rate of the market has their own speeds, while there should be a proper co-ordination between these two.

Conclusion:

Considering the above mentioned failures of the RBI it can be said that there is a need of making the credit control of the RBI even more rigid. The uncontrolled areas will have to be considered and brought under the limit of control. There is a need of solid financial discipline for the non-banking institutions particularly.