Are you looking for an essay on ‘Capital Market’? Find paragraphs, long and short essays on ‘Capital Market’ especially written for school and college students.

Essay # 1. Meaning and Features of Capital Market:

Capital market refers to such market in which all those facilities and institutions are included which are involved in the functions of meeting the long-term financial requirements. The main practice in this market is sale and purchase of shares and debentures. This market encourages people to invest their small savings in productive activities. This benefits the investors, those who demand finance in the economy.

The main Features of the capital market are as follows:

(1) Important Component of Financial Market:

There are two parts of financial market:

i. Money market, and

ii. Capital market.

The capital market plays an important role in fulfilling the long-term financial requirements of the economy. The development of industries has taken place due to capital market only.

(2) Dealing in Securities:

Long-term securities refer to such securities which have more than one year of maturity period. This market deals in marketable and non-marketable government and non-government securities. The marketable securities includes shares and debentures issued by companies and bonds etc. issued by the government while the non-marketable securities include the fixed deposits with banks and companies and loans and advances given to industrial institutions.

(3) Segments:

There are two segments of the capital market-Primary market and secondary market. New shares are issued in the primary market while previously purchased shares are sold and purchased in the secondary market.

(4) Intermediaries:

The capital market works through various intermediaries who include under writers, mutual funds, stock brokers, banks etc.

(5) Investors:

There are both individual and institutional investors investing in long-term funds in the capital market.

(6) Flow of Capital:

This market makes the flow of capital from investors to the needy people. This provides an economic stage to those who demand capital and those who supply capital.

(7) Helpful in Capital Formation:

There is opportunity of investment in the capital market. It brings profit. This profit is again invested and the sequence goes on. This leads to capital formation.

Essay # 2. Types of Capital Market:

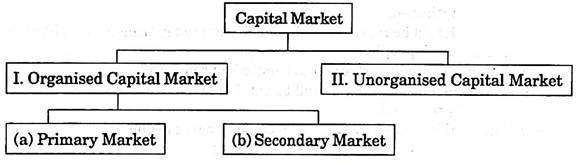

There are two types of capital market:

i. Organised Capital Market, and

ii. Unorganised Capital Market.

Again, the organised capital market includes primary and secondary capital markets.

The types of capital market can be clarified with the help of the following diagram:

I. Organised Capital Market:

The organised capital market refers to such Capital Market which is bound with certain rule or controlled by the government or any organisation of the government. Indian capital market is controlled by Securities and Exchange Board of India—SEBI and RBI.

There are two parts of organised capital market:

(a) Primary Market and

(b) Secondary Market.

(a) Primary Market:

Primary Market relates to new issues. Through this market newly established company and old company collect capital. There is first time sale of shares, debentures and other securities in the primary market to collect long-term capital. When any company issues new shares or debentures it is called Initial Public Offer (IPO). It is worth—mentioning here that Primary Market is not any geographical area but it is an activity of new issuing by companies. In this market, flow of money is from savers to industries.

Dealing Process in Primary Market:

There are following methods of collecting capital from primary market:

(1) Public Issue:

In this process, the company invites the people to purchase shares or debentures by issuing prospectus. Prospectus refers to such advertisement, information or request through which people are invited to buy shares or debentures. The points mentioned in the prospectus should be according to the guidelines of Indian Company Act and SEBI.

(2) Offer for Sale:

In this process of issuing, the company proposes to sell the issuing of securities to its promoters or share brokers on pre-determined prices. Later the shares are sold to common people on high prices through brokers or other mediators. So, in this process company does not sell securities directly to people.

(3) Private Placement:

In this process of issuing, the company can sell its securities privately to small groups of investors which includes brokers, financial institutions etc. This process is adopted particularly in the collaboration of the domestic and foreign companies. The company is prevented from the cost of public issuing.

(4) Right Issue:

When any old company wants to collect surplus capital, it proposes to its current shareholders to buy extra equity shares in then ratio of their current shares. This process is called Right Issue. The shareholder can accept this proposal themselves or can transfer in the favour of somebody else.

(5) Electronic Initial Public Offer (IPOs):

In this process, the company issues the initial public offer through electronic medium after taking the approval of SEBI. Internet is its basis. In this process, the brokers authorised by SEBI are appointed to accept online application form. The company issuing securities also appoints a registrar to fulfill the work of issue.

Thus, the issuing of securities in the primary market can be done through any of the above mentioned processes.

(b) Secondary Market:

When any security is resold, it is called secondary market activity. Such activities are generally fulfilled through stock exchange. Secondary market provides liquidity to securities. Only those securities which are listed with the stock exchange are dealt in the secondary market. In the words of Payle, “A stock exchange is a place where listed securities are sold and purchased with the view of investment and speculation.”

II. Unorganised Capital Market:

Unorganised capital market includes indigenous bankers, creditors and pawn brokers. It has little control of RBI and SEBI. However these days the grasp of RBI and SEBI on this sector has increased in the interest of investors.

Essay # 3. Instruments of Capital Market:

The securities which are dealt in the capital market are called the instruments of capital market. The main instruments of the capital market include shares, debentures and bonds.

These can be explained in the following ways:

Shares:

The smallest divisible units of total capital of any joint stock company are called shares.

According to M. C. Kuchhal, “A share in a company is one of the units into which the total capital of the company is divided.”

Kinds of Shares:

According to Indian company Act, 1956, there are two kinds of shares:

1. Preference shares, and

2. Equity shares.

(1) Preference Shares:

The preference shares refer to those shares on which there is preference of getting dividend on the pre-determined rate and capital return in the case of the liquidation of the company.

There are following types of preference shares:

(i) Cumulative Preference Shares:

The holders of these shares has right to get dividend first of all. If in a year, the bearer of such shares don’t get dividend due to insufficient profit or no profit, such dividend becomes cumulative so long as they are not completely paid.

(ii) Non-Cumulative Preference Shares:

The dividend of such shares is not cumulative. If in a year, the company does not declare any dividend for any reason, the holder doesn’t get any dividend nor is it considered to be due.

(iii) Participating Preference Shares:

Participating Preference Shares are those shares which are entitled to a share in the surplus profit of the company which remains after payment to equity shareholders. Thus, these shares get a share in surplus profit apart from fixed rate of dividend.

(iv) Non-Participating Preference Shares:

The holders of such shares have the authority of getting dividend at a fixed rate only. If the articles of associations are silent, all preference shares are assumed to be cumulative and non-participating.

(v) Redeemable Preference Shares:

These are such shares the amount of which is redeemable during the lifetime of company according to the condition of issuing.

(vi) Irredeemable Preference Shares:

The amount of this share cannot be refunded before the liquidation of the company.

(vii) Convertible Preference Shares:

The holders of this share have the authority that they can get these shares converted into equity shares according to the condition of issuing.

(viii) Non-Convertible Preference Shares:

The holders of this share are not given the right to convert their shares into equity shares.

(2) Equity Shares:

Equity shares refer to those shares which are not preference shares. They get dividend from the amount remaining after giving dividends to the preference shareholders from the divisible profits. According to the Article 85(2) of the Indian Company Act, 1956, “Equity shares refer to those shares which don’t have preference as in the case of preference shares.”

Sweat Equity Shares:

Sweat Equity Shares are those shares which are issued by the company to its employees or directors at a discount or for consideration other than cash for providing know-how or making available intellectual property rights provided that not less than one year has lashed since the date of commencement of business. Such shares cannot be resold within a period of one year.

Debenture and Bonds:

Debenture is an agreement between the creditor and the company according to which the company makes the promise of repaying the loan taken by it along with proper interest, according to the Article 2(12) of the Indian Company Act, 1956, “Debenture includes debenture of stock, bonds and any other security of a company whether constituting a charge on the assets of the company or not.”

Similarly bond is also a document resembling debenture. Generally bonds are issued by the government, but these days even the semi-government and non-government organisations have started issuing bond as the evidence of loan.

There is one fundamental difference between bond and debenture that in the case of debenture the interest rate is predetermined, while bonds can be issued without predetermined interest rates some examples are—Deep Discount Bond, Zero Coupon Bond etc.

Kinds of Debentures:

The types of debentures are as follows:

(1) Registered Debentures:

The names of the holders of these debentures are mentioned in the register of the company. The redemption of debentures with interest is made only to those persons whose name is there in the register of the company. This debenture is not transferred independently.

(2) Bearer Debentures:

The payment of the principal and interest on this debenture is done to the bearer of the debenture.

(3) Secured or Mortgaged Debentures:

These are such debentures for the payment of which either some particular assets of the company called fixed charge or all the assets called floating charge are mortgaged. In the case of any fault or failure in the payment of principal or interest, the company can’t sell the mortgaged property.

(4) Unsecured or Naked Debentures:

These are such debentures on which the assets of the company are not mortgaged for the payment of principal or interest.

(5) Redeemable Debentures:

These are such debentures the payment of which is done during the life time of the company as a lump sum amount or in installments.

(6) Irredeemable Debentures:

The payment of the principal of this debenture is not in the life time of the company. Holders of such debentures cannot demand their repayment before the winding up of a company.

(7) Convertible Debentures:

The holders of these debentures are given an option to convert them into shares at a stated rate of exchange after a certain period.

(8) Non-Convertible Debentures:

Such debentures cannot be converted into equity shares in any condition.